For government employees in India, the Government of India runs the Employees Provident Fund (EPF) Scheme for retired employees under which the benefit of retirement savings scheme can be availed. This scheme is run by the Employees Provident Fund Organization (EPFO) under the Ministry of Labor and Employment. Retired employees can easily avail the benefits of this scheme.

This webpage provides information about on EPFO, including EPF Passbook, Claim Status, KYC updates, Online Claim for withdrawing PF amounts, UAN Login, and more.

Note – Users can utilize UMANG to check their PF balance, raise claims, apply for Scheme Certificate, apply for UAN, link UAN with Aadhaar, check claim status, search for establishments, view EPFO office addresses, register grievances, and apply for Jeevan Pramaan certificates.

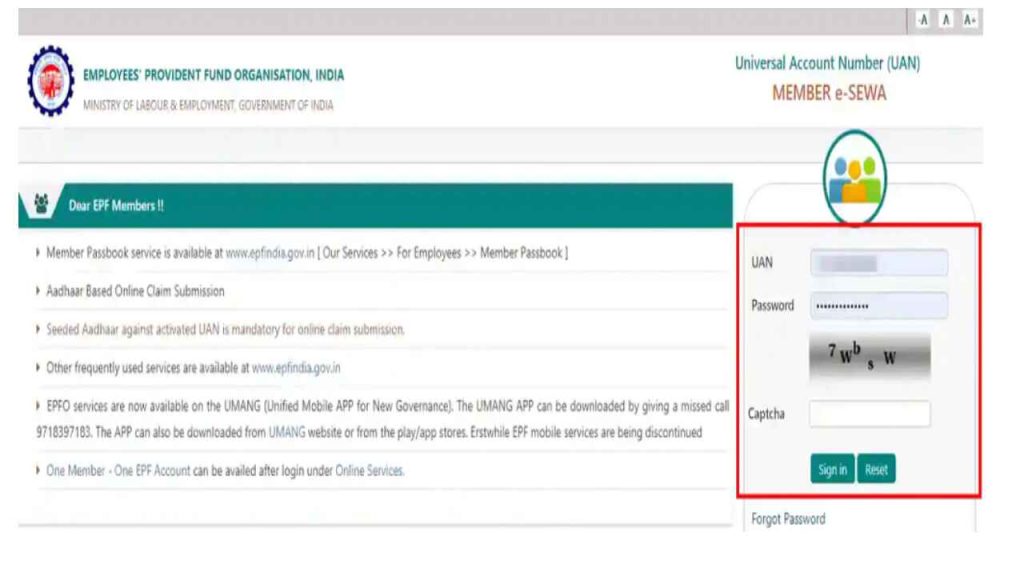

EPFO UAN Login Portal

Users get many types of services on the official website of epfo uan login passbook. To access the portal, follow the steps given below:

- Go to the official website https://www.epfindia.gov.in.

- After this, click on the option of services in the menu bar at the top of the home page

- After clicking on the option of services, you will see four options like this

| For Employers Log In | Click Here |

| For Employees Log In | Click Here |

| For International Workers Log In | Click Here |

| For Pensioners Log In | Click Here |

- You have to choose any option according to your situation, after this you can log in and take advantage of the services provided by EPFO

EPF Passbook & Claim Status Check Online

To check EPF passbook online, you can check your balance and also know about the claim status by following the steps given below.

- Go to EPF website: For this, first of all you have to go to the official website of the app https://www.epfindia.gov.in/site_en/index.php.

- Select Option e-Passbook: After this, on the home page, you have to click on the option of e-passbook.

- Log In: After this, to Log in, you have to enter your Universal Account Number and Password on the Facebook Passbook page, followed by the captcha code.

- View Your Passbook: After logging in, you can easily view your EPFO member passbook, which includes your transaction contribution and how much interest has been added.

- Check Your Balance: To check your balance in the passbook, you can click on the total balance of the EPF account.

- Manage Claims: Also, if you have submitted a new form or want to track the status of an existing EPFO claim, then use the online platform

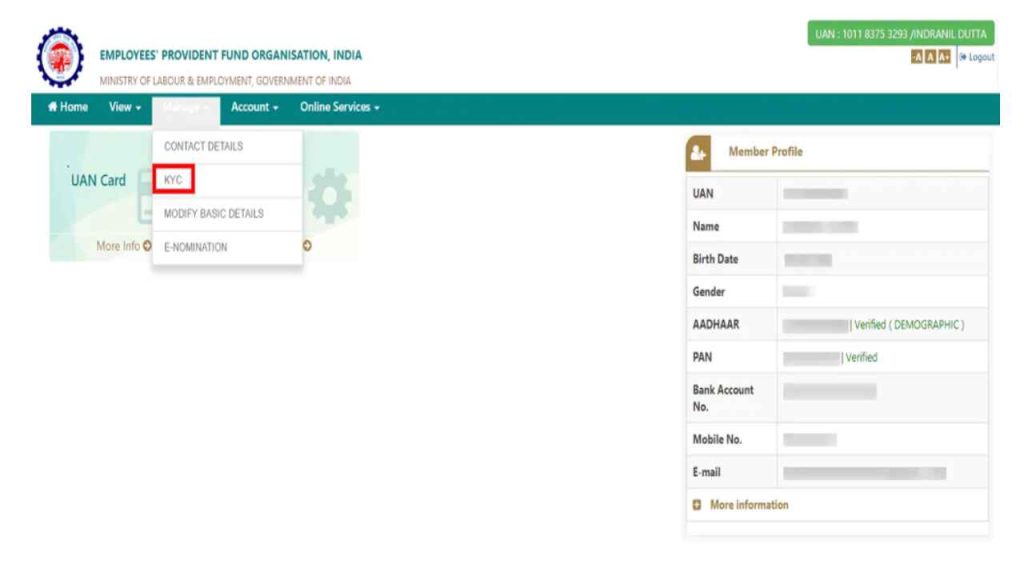

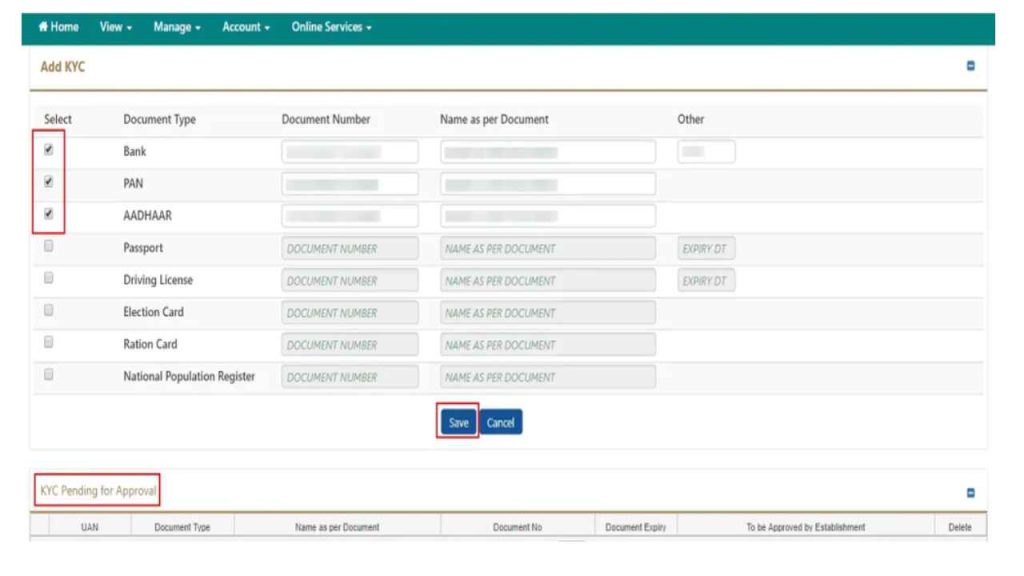

Member KYC Update

- Visit the EPFO’s member portal Online at https://unifiedportal-mem.epfindia.gov.in/memberinterface/.

- epfo member login in using your UAN, Password, and complete the Captcha verification.

- Next you go to the ‘Manage‘ option in the menu bar and select ‘KYC‘ from the drop-down menu.

- Now a new page will open and you will have to click on the check box and update the required document by uploading it

- After this, you will have to click on the KYC button and fill all the required information correctly and after this you will have to click on the save button

- After this, all your updated details will appear under KYC pending for approval. After this, after the approval of the employer, your digital identity will be converted into approved KYC.

EPF Online Claim Process

To withdraw your withdraw pf amount online using uan, follow the steps given below and you can easily withdraw your PF.

- First of all you have to go to EPFO e-SEWA portal and login there with UAN and password

- After login you have to go to Online Services Payment and there choose Claim (Form-31, 19, 10C & 10D)

- After this you have to enter your bank account number for verification

- After this you have to click on Proceed for Online Claim to verify all your information and agree to it as per EPFO’s terms and conditions

- Select the correct reason for your PF withdrawal from the drop down menu After this you have to fill your address and also upload the document of check or passbook

- And after this request OTP for verification Once your OTP is verified OTP will be sent to your mobile number and in this way you can Enter this OTP to submit your claim application successfully.

Withdrawal Rules Note – Complete withdrawal from the EPF account is permissible upon retirement, unemployment lasting more than two months, or when changing jobs under specified conditions. Partial withdrawals are allowed for specific purposes, subject to conditions tailored to each circumstance.

About EPF scheme

What is EPF ? – Employee Provident Fund Scheme (EPF) is one of the major schemes of India. It is a scheme made for the retired employees of India. This scheme is overseen by the Government of India and is under the jurisdiction of the Employees Provident Fund Organization (EPFO). This scheme provides second security to the employees of both public and private sectors after retirement and secures their future.

Contributions

PF contributions are divided into two components: the employee’s contribution, deducted from their salary, and the employer’s contribution, added monthly. Both parties contribute 12% of the basic wage as per section 2(b) of the act.

Out of the employer’s 12% contribution, 8.33% is allocated to the Employee Pension Scheme (EPS) and 3.67% to the Employees’ Provident Fund (EPF). Additionally, employers cover 0.50% for EPF administrative charges and 0.50% for EDLI (Employee’s Deposit Linked Insurance) charges, making the total contribution by the employer 13% of the basic wage.

Interest Rate 2024-25

The interest rate on EPF deposits fluctuates between approximately 8.15% to 8.25% per annum, subject to adjustments according to government policies. This interest is compounded annually.

| Financial Year | EPF Interest Rate |

| 2016 | 8.65% |

| 2017 | 8.55% |

| 2018 | 8.65% |

| 2019 | 8.50% |

| 2020 | 8.50% |

| 2021 | 8.10% |

| 2022 | 8.15% |

| 2023 | 8.25% |

| 2024 | 8.20% |

Also Read – ABC ID

Tax Benefits

EPF contributions are eligible for tax deduction under Section 80C, and the interest earned as well as withdrawals after five years of service are tax-free. Withdrawals made before completing five years are subject to taxation based on the individual’s applicable tax rate.

Eligibility

Regarding eligibility, the EPF scheme is mandatory for organizations employing 20 or more individuals, with all employees of such organizations automatically enrolled into the scheme. However, organizations with fewer employees also have the option to voluntarily opt for this scheme.

Features and Benefits

- Employees receive a lump-sum amount at retirement, comprising their own contributions, the employer’s contributions, and accumulated interest.

- In addition to the provident fund, the scheme offers pension benefits through the Employees’ Pension Scheme (EPS) and insurance coverage under the Employees’ Deposit Linked Insurance Scheme (EDLI).

- While the primary goal is to provide financial stability after retirement, the scheme allows for partial withdrawals under specific circumstances such as medical emergencies, home purchase, education, and marriage.

- Each member is assigned a Universal Account Number (UAN), which facilitates online management of the EPF account. It streamlines the process of fund transfers when changing jobs.

About EPFO

The Employees’ Provident Fund Organization is a ministry created by the Government of India under which the Employees’ Provident Fund is managed, which helps to promote retirement savings for workers across India. It was established in 1951. It is one of the largest EPFO social security organizations in the world. It provides financial assistance to millions of employees. There are currently 55,981 self-generated UANs and last year a significant increase has been seen in the number of members contributing to the Employees’ Provident Fund Organization. For more information, see the EPFO Chart Dashboard

| Address | The head office of the Employees’ Provident Fund Organisation (EPFO) is located at Bhavishya Nidhi Bhawan, 14, Bhikaiji Cama Place, New Delhi – 110066. |

International workers are covered under EPFO plans in countries where bilateral agreements have been established. For more information, visit the International Workers Portal on the EPFO website.

The Central Board of Trustees (CBT) is the highest decision-making body of the EPFO, established by the Employees’ Provident Fund and Miscellaneous Provisions (EPF&MP) Act, 1952.

Ms. Neelam Shami Rao serves as the Central Provident Fund Commissioner (CPFC) and CEO of EPFO, assuming office on 07-12-2021. For further details, refer to the EPFO FAQ page.

Schemes:

- Employees’ Provident Funds Scheme 1952 (EPF): This primary scheme under EPFO offers retirement benefits to employees. Both employees and employers contribute a specified percentage of the salary towards this fund.

- Employees’ Pension Scheme 1995 (EPS): This scheme provides pension benefits to employees in the organized sector after retirement, ensuring a steady income during their post-retirement life.

- Employees’ Deposit Linked Insurance Scheme 1976 (EDLI): This scheme provides life insurance benefits to employees, ensuring financial security for their families in case of the employee’s untimely death.

Features:

- Digital Life Certificate:

- Online Profile Updates:

- Establishment e-Report Card:

- Pensioners’ Portal and Calculators:

- International Workers Portal:

- Mobile Life Certificate Submission:

- TRRN Query Search:

- Nirbadh Initiative:

Vision & Mission

EPFO strives to be an innovation-driven social security organization dedicated to meeting the evolving requirements of comprehensive social security through transparent, contactless, faceless, and paperless processes. It ensures uninterrupted services with a multi-location and automated claim settlement process to enhance disaster resilience.

Epfigms Grievance Portal

EPFO offers an online grievance management system known as EPF i Grievance Management System (EPFiGMS). Through this platform, employees can register their complaints and monitor the progress of their grievances. This system emphasizes accountability and aims to resolve EPF members’ issues promptly.

For assistance, individuals can also contact the toll-free number 14470 for support and guidance related to EPFO services.

EPFO Help Desk

| Click Here | |

| Click Here | |

| Click Here | |

| epfo help whatsapp number Link | Click Here |

FAQs

1. What is UAN?

Ans : The Universal Account Number (UAN) is a unique 12-digit number assigned to every employee who contributes to the Employees’ Provident Fund (EPF) scheme in India. It serves as a portable identity for the employee’s EPF account throughout their career.

2. How To PF Balance check with uan number?

Ans : Giving a missed call to 9966044425 from their registered Mobile number.